Best Crypto Exchanges (2023)

Choosing the right the right crypto exchange is not an easy task. Here we will recommend the five largest volume exchanges that may offer some degree of protection. Since the fallout of FTX and Sam Bankman-Fried, the important aspect to remember is not the currencies you buy but rather the holder of that currency. Since this is a non regulated domain, and your money basically goes into an "asset" that can be untraceable and held in a wallet, makes this more risky than your stock market trading where it is highly regulated. Some of the non recommended exchanges will be listed below.

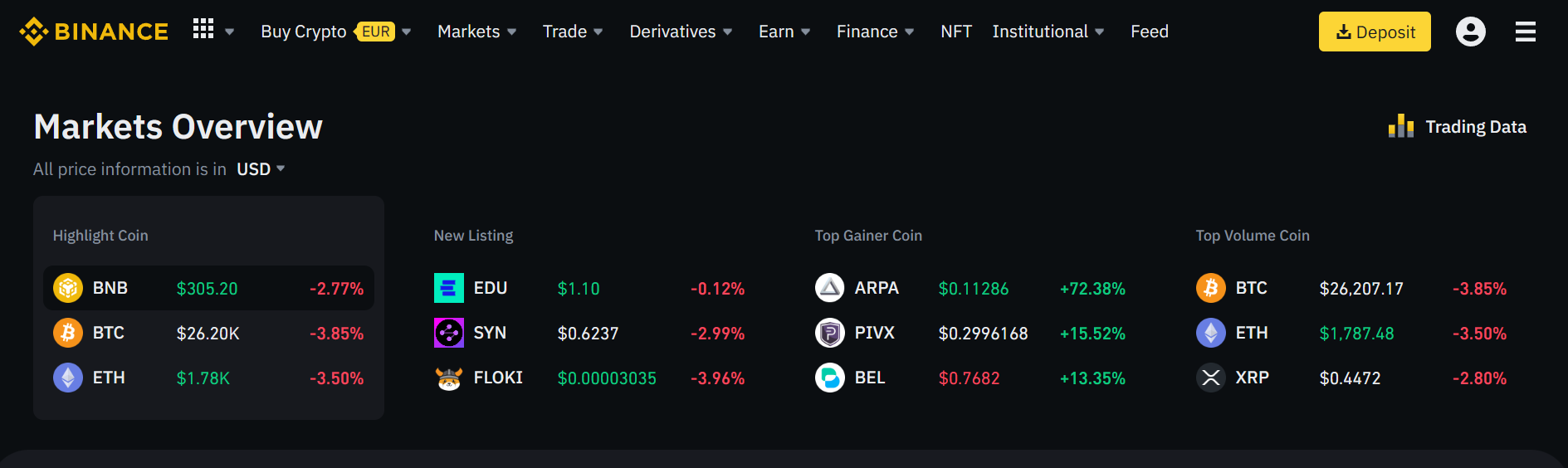

Binance

Binance is the world's largest cypto exchange in the world with over 80 billion dollars daily trading volume.There are over 350 cryptocurrencies listed and thousands of trading pairs.

Coinbase

Coinbase is one of the most popular and trusted cryptocurrency exchanges in the world. Founded in 2012, Coinbase has grown to serve over 73 million users in over 100 countries.

Kraken

Kraken is one of the most established and popular exchanges in the world. Although not as familiar as Binance and Coinbase some attributes are worth mentioning.

Kucoin

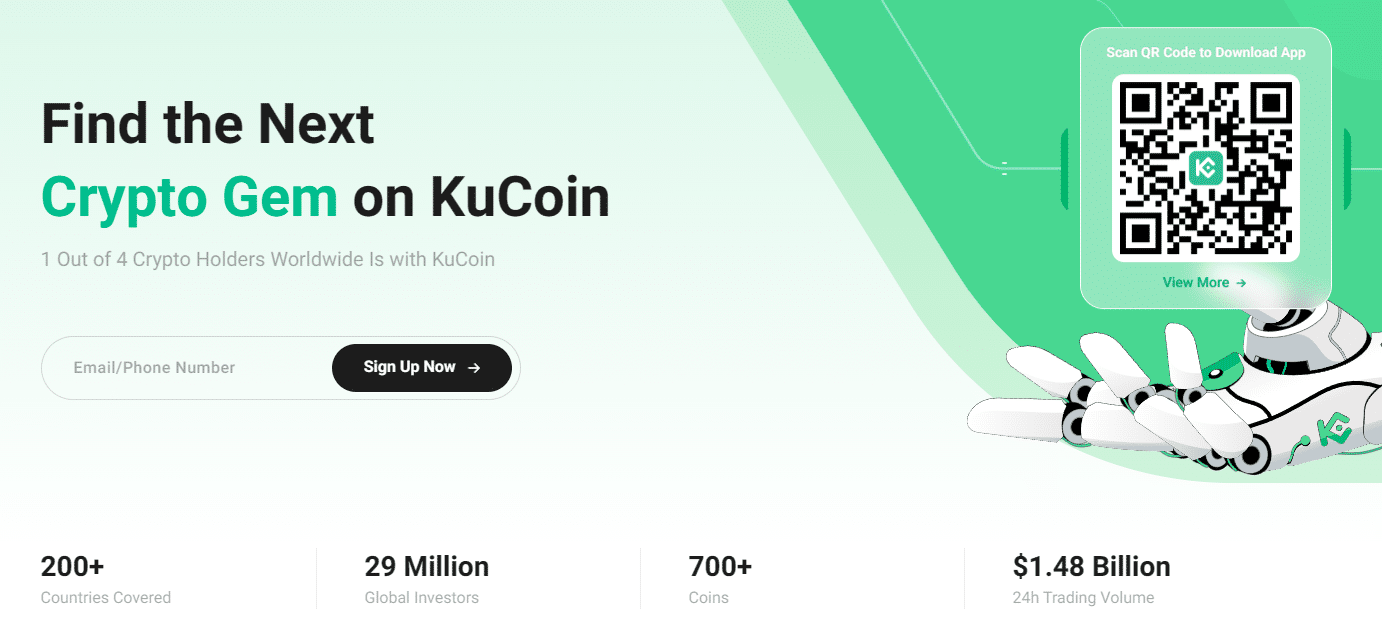

Kucoin is a cryptocurrency that operates in over 200 countries. They offer a wide selection of supported assets and services, as well as low trading fees. Read more for full description.

OKX

OKX is a one-stop cryptocurrency platform that offers a variety of services, such as trading, staking, lending, mining, and learning

Who Are The best Crypto Exchanges

Crypto exchanges are the stock exchanges of the digital world.

And just as stock exchanges list hundreds or thousands of stocks, crypto exchanges make it possible to buy, sell, and swap hundreds or thousands of digital currencies. Collectively, those currencies constitute the crypto market.

A cryptocurrency is a digital currency, which is an alternative form of payment created using encryption algorithms. The use of encryption technologies means that cryptocurrencies function both as a currency and as a virtual accounting system. To use cryptocurrencies, you need a cryptocurrency wallet.

As crypto grows in popularity and adoption, it may be used more frequently for purchases. Right now, it is not recognized as real currency by the U.S. government. However, it can be used in the same way as U.S. fiat money in many circumstances.

There are several risks associated with investing in cryptocurrency: loss of capital, government regulations, fraud and hacks. Loss of capital. Mark Hastings, partner at Quillon Law, warns that investors must tread carefully in crypto's unique financial environment or risk significant losses.

1. Binance

Most Valuable Most Traded On Crypto Exchanges.

Our Take

The Binance ecosystem now comprises of Binance Exchange, Labs, Launchpad, Info, Academy, Research, Trust Wallet, Charity, NFT and more. Binance was launched in June 2017, and within 180 days grew into the largest cryptocurrency exchange in the world.

| Best For | Low Fees |

|---|---|

| Price | Depending on how you purchase |

| Annual Discount | No |

| Promotion | None |

The global company was co-founded in China by Changpeng Zhao and Yi He. A Chinese-Canadian developer and business executive, Changpeng Zhao, who goes by CZ, is the company's CEO. He studied at McGill University Montreal and had a successful track record as an entrepreneur. His past experiences include Head of Bloomberg Tradebook Futures Research & Development team, founder of Fusion Systems and Head of Technology at Blockchain.com.

Yi He is CMO at Binance and Head at Binance Labs, the company’s venture capital arm. Yi was previously Vice President at a leading mobile video tech company, Yixia Technology, and co-founder of digital asset exchange OKCoin.

Under the Binance Terms of Use, restricted locations include the United States, Singapore and Ontario (Canada). However, some countries have restricted usage or features might be limited due to regulatory reasons, including but not limited to, China, Malaysia, Japan, UK and Thailand. Futures and derivatives products are also not available in Germany, Italy and The Netherlands. In September 2019, a separate dedicated platform for US clients, Binance.US, was launched.

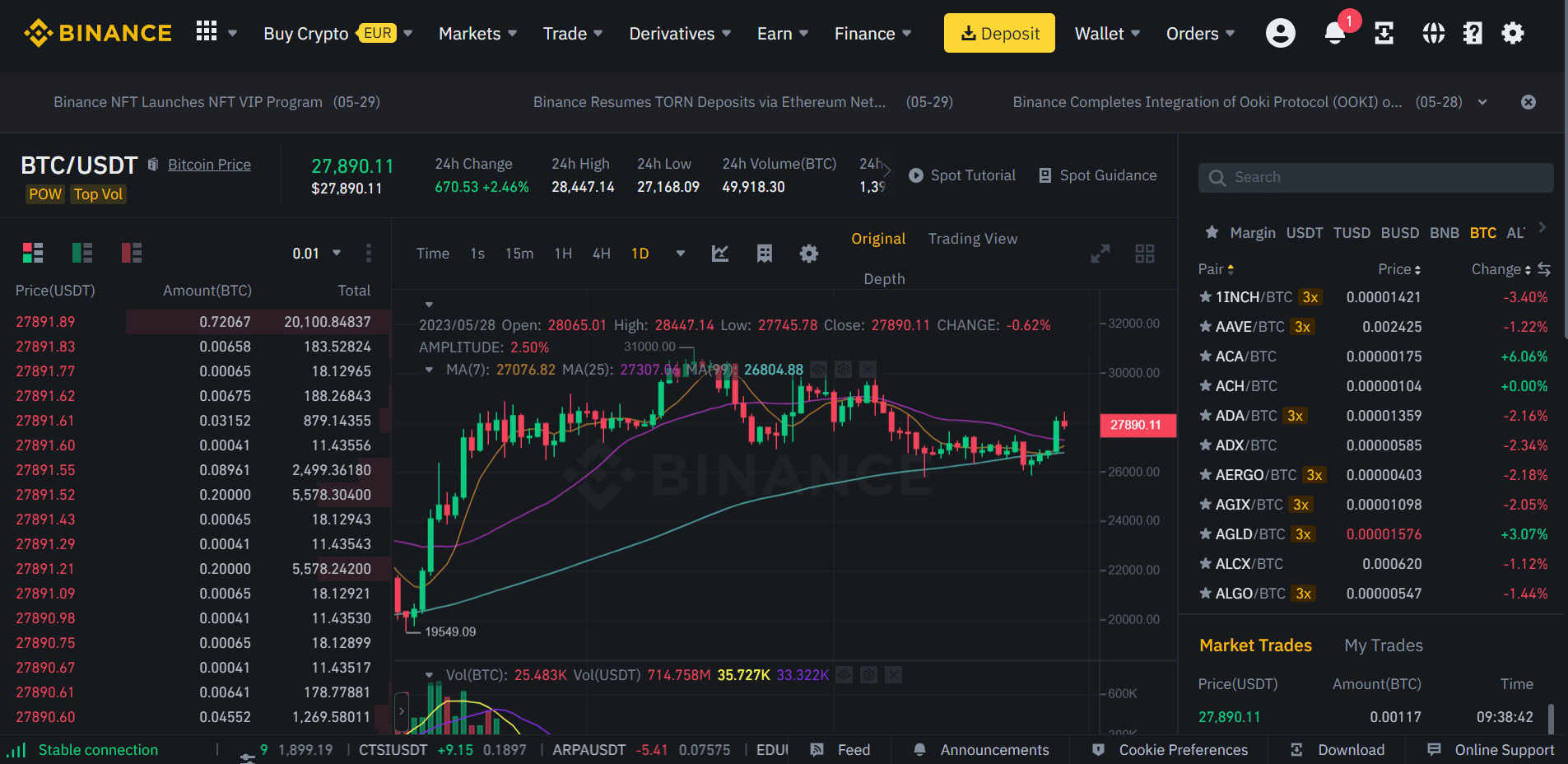

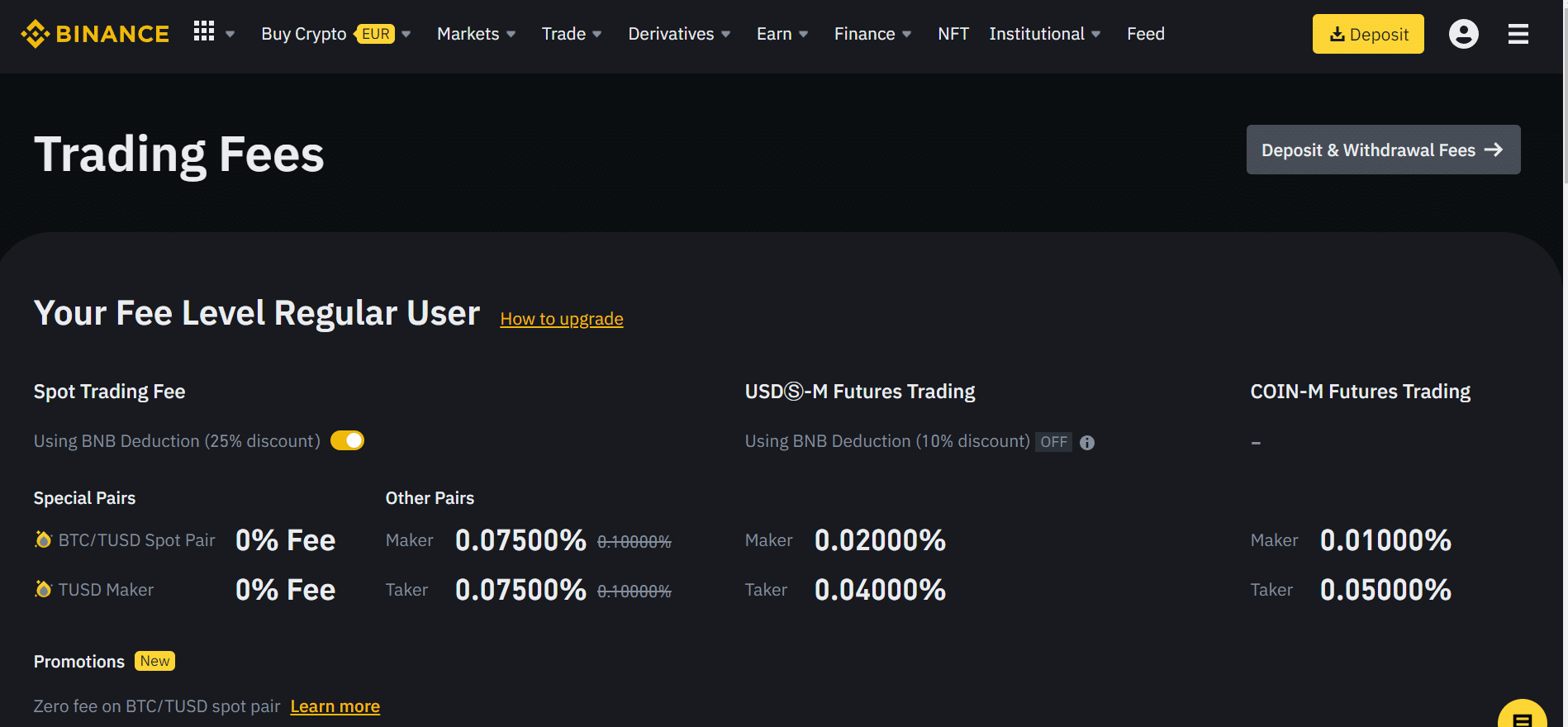

The platform is user-friendly and one of the cheapest with a huge selection of transaction types and an advanced set of trading tools for experienced investors. It charges based on a tiered system, from regular users to VIP 9. For regular users, a 0.10% maker taker fee is charged for spot trading. In July 2022, Binance announced zero-fee trading for BTC spot trading pairs, and in August for ETH/BUSD pair.

Traders can borrow funds and participate in margin trading on Binance Margin, which allows trading cryptocurrencies with up to 10X leverage. Users can also use derivatives products such as Binance Futures, settled in USDT, BUSD or other cryptocurrencies and Binance Options to leverage on their trades.

Quick Transactions. BNB gives you access to the platform's in-house matching engine, which can process up to 1.4 million orders per second when you trade on the exchange.

Binance's major disadvantage is its ongoing legal challenges and regulatory issues. The company is facing problems with countries in Europe, Asia, and North America

Key Features:

- Fast account opening process

- Low fees

- Hundreds of cryptocurrencies pairs

- Secure multi-currency wallet

- Basic and advanced trade setups

- Good liquidity

- Extensive educational resources

User Experience:

Binance is the largest cryptocurrency exchange in the world by trading volume. In 2022 the company was offered to buy rival FTX, another large crypto exchange. However, on Nov. 9, 2022, soon after the offer was issued, Binance said it would walk away from FTX after reviewing its financial condition

Pricing:

Binance Fees are diverse, see website for full details.

Like/Dislike About Binance:

Like:

- Low fees.

- A wide range of cryptocurrencies, various trading options and order types with helpful support and learning resources.

- Easy to open account.

Dislike:

- On the negative side, Binance has a limited U.S. version, a complex and confusing platform, no built-in digital wallet, and regulatory issues in several countries. Users may want to consider these factors before choosing Binance as their crypto exchange.

Product Updates

- Binance Card: Binance’s official crypto debit card allows users to spend crypto directly from their Binance wallet with Visa or Mastercard-supported merchants. The card offers up to 8% cashback on purchases and is available in several markets, including Ukraine, Argentina, Bahrain, Brazil, Colombia, and more1.

- Binance Pay: Binance’s borderless payment technology enables users to pay and get paid in crypto with over 70 supported cryptocurrencies. Binance Pay has added 7,983 new merchants and partners in 2022, including Shopify, Booking.com, Travala.com, and more2.

- Binance NFT: Binance’s non-fungible token (NFT) platform offers users access to exclusive collections, mystery boxes, fan tokens, and more. Binance NFT has also launched a new AI-powered NFT profile picture generator called Bicasso, which allows users to create unique and personalized NFT avatars3.

Get started with Binance

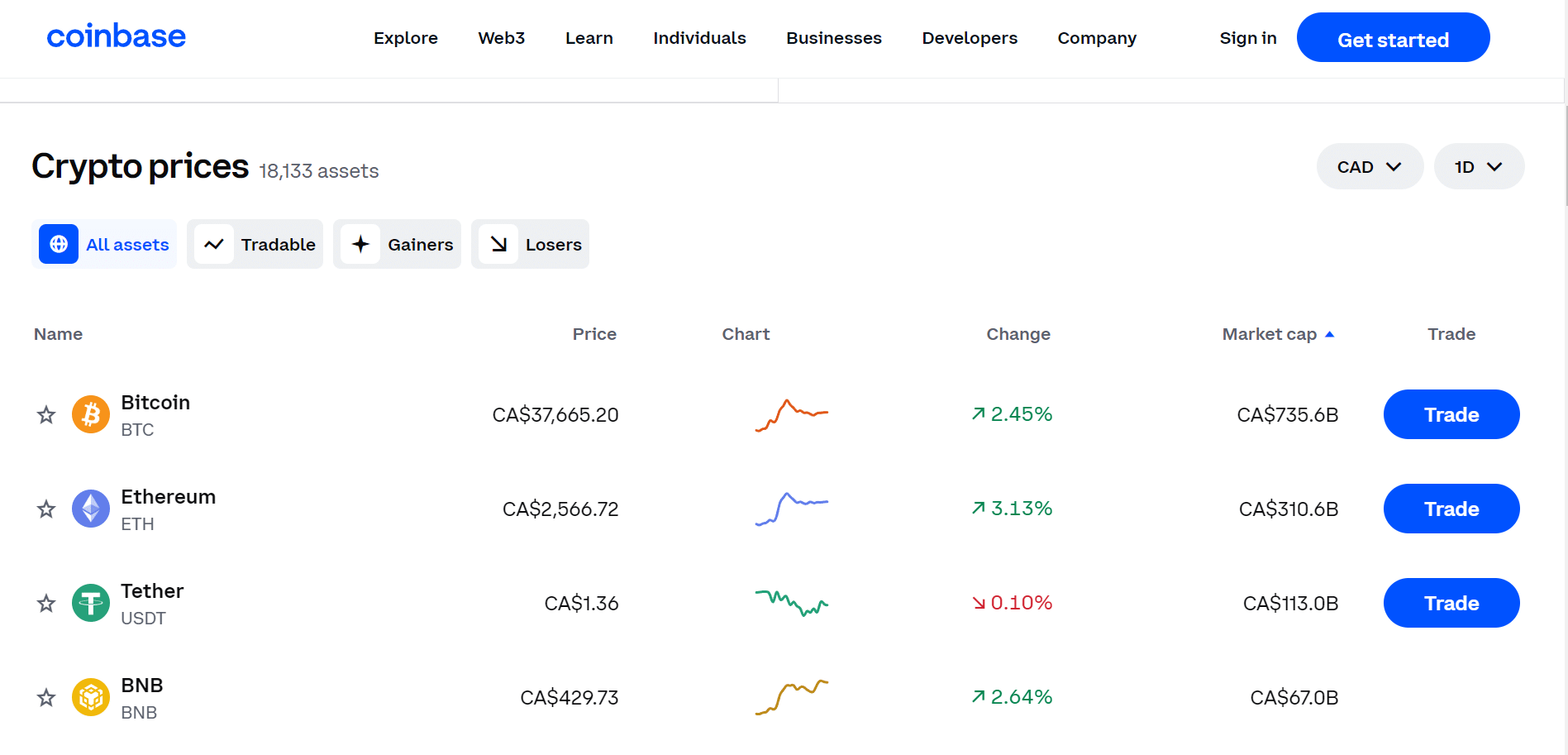

2. Coinbase.

One of the most popular and trusted cryptocurrency in the world.

Our Take

Coinbase is one of the most popular and trusted cryptocurrency platforms in the world. It allows users to buy, sell, store, and trade more than 250 cryptocurrencies, including bitcoin, ethereum, dogecoin, and many others. It also offers various services and products for businesses and institutions that want to use crypto in their operations.

But what are the pros and cons of using Coinbase? And how did it become such a successful company? Here is a brief overview of Coinbase’s benefits, drawbacks, and history.

| Best For | Ease Of Use |

|---|---|

| Price | Check Website For Fees |

| Annual Discount | None |

| Promotion | None |

GoDaddy used to be known as a domain registrar that provided good service at reasonable prices.

Ease of use: Coinbase has a user-friendly and intuitive interface that makes it easy for beginners and experts alike to access the cryptoeconomy. Users can sign up, verify their identity, link their bank account or card, and start buying or selling crypto in minutes. Coinbase also has a mobile app that lets users manage their portfolio on the go

High liquidity: Coinbase has a large and active user base that provides high liquidity and fast execution for crypto transactions.

Users can benefit from competitive prices and low spreads when trading on Coinbase. Coinbase also supports instant transfers between Coinbase accounts, as well as withdrawals to PayPal or bank accounts.

- Security: Coinbase is one of the most secure crypto platforms in the world. It uses industry-standard encryption, multi-factor authentication, and offline storage to protect user funds and data. It also has a strong compliance program that adheres to regulatory requirements in all jurisdictions where it operates. Moreover, Coinbase insures user funds against theft or hacking up to $250,000 per account.

- Variety: Coinbase offers access to more than 250 cryptocurrencies, including some of the most popular and innovative ones in the market. Users can diversify their portfolio and explore new opportunities in the crypto space. Coinbase also supports non-fungible tokens (NFTs), which are unique digital assets that represent art, collectibles, gaming items, and more.

- Education: Coinbase provides various resources and tools for users who want to learn more about crypto and blockchain technology. Users can access guides, videos, podcasts, blogs, newsletters, and more on Coinbase’s website and app. Users can also earn free crypto by watching educational videos and completing quizzes on Coinbase Earn.

- Fees: Coinbase charges fees for every transaction on its platform. These fees vary depending on the type of transaction, the payment method, the location of the user, and the market conditions. Generally, Coinbase charges a spread of 0.50% for buy/sell transactions, plus a transaction fee that ranges from $0.99 to $2.99 depending on the amount. For more advanced traders who use Coinbase Pro or Coinbase Advanced Trade, the fees can go up to 0.60% per trade.

- Regulation: Coinbase is a centralized and regulated platform that complies with various laws and regulations in different countries. This means that Coinbase may require users to provide personal information, verify their identity, report their transactions, or limit their access to certain features or services depending on their location or jurisdiction. Some users may prefer more privacy or freedom when using crypto platforms

- Staking: Staking is a process where users lock up their crypto assets in exchange for rewards or interest. Staking can help users earn passive income while supporting the security and functionality of certain blockchain networks. However, Coinbase only supports staking for a few cryptocurrencies, such as ethereum 2.0 (ETH2), tezos (XTZ), cosmos (ATOM), algorand (ALGO), and dai (DAI). Users who want to stake other cryptocurrencies may need to use other platforms or wallets.

Key Features:

- Buy, sell, and exchange crypto: Coinbase allows users to buy, sell, and exchange over 250 cryptocurrencies.

- Store and manage crypto: Coinbase provides users with a secure and convenient way to store and manage their crypto assets. Users can access their portfolio on the web or on the mobile app, and view their balances, transactions, and prices.

- Earn and learn crypto: Coinbase offers users various opportunities to earn and learn crypto.

- Spend and save crypto: Coinbase enables users to spend and save crypto in various ways.

- Explore web3 and NFTs: Coinbase helps users discover and participate in the web3 ecosystem, which is powered by decentralized applications (dapps) that run on blockchain networks.

User Experience:

Users can use Coinbase Wallet to store their own crypto and access dapps, such as decentralized exchanges (DEXs), lending platforms, gaming platforms, and more. Users can also use Coinbase NFT to create, collect, and connect with other NFT enthusiasts.

Users can also use Coinbase Direct Deposit to get paid in crypto or USD with zero fees.

Pricing:

Fees: Coinbase charges fees for every transaction on its platform. These fees vary depending on the type of transaction, the payment method, the location of the user, and the market conditions. Generally, Coinbase charges a spread of 0.50% for buy/sell transactions, plus a transaction fee that ranges from $0.99 to $2.99 depending on the amount. For more advanced traders who use Coinbase Pro or Coinbase Advanced Trade, the fees can go up to 0.60% per trade.

Like/Dislike About Coinbase.

Like:

- Ease Of Use

- High Liquidity.

- Security Factors.

Dislike:

- Recent rumors in April of 2023 that Coinbase was on verge of bancruptcy and having financial issues.

- Very poor customer service, as there is no direct line for communication.

Product Updates

- Sign-Up and Account Recovery: Coinbase has updated the sign-up process for new customers in the US to make it faster and easier. Customers can now sign up with just their name, email, and password, and verify their identity later when they want to buy or sell crypto. Coinbase has also added a new feature to allow customers to recover their account if they no longer have access to the email address they registered with. Customers can request a recovery link to be sent to their phone number or a new email address

- Coinbase One: Coinbase One is a subscription service that offers customers more value and benefits from using Coinbase. For $29.99/month, customers can enjoy zero trading fees, boosted staking rewards, a dedicated support team, a pre-filled tax form, and exclusive partner deals. Coinbase One is now available in the US, UK, Germany, and Ireland2

- Coinbase NFT: Coinbase NFT is a platform that allows customers to create, collect, and connect with other NFT enthusiasts. NFTs are unique digital assets that represent art, collectibles, gaming items, and more. Customers can use Coinbase NFT to mint their own NFTs, browse and buy NFTs from various collections, and join communities of NFT creators and collectors

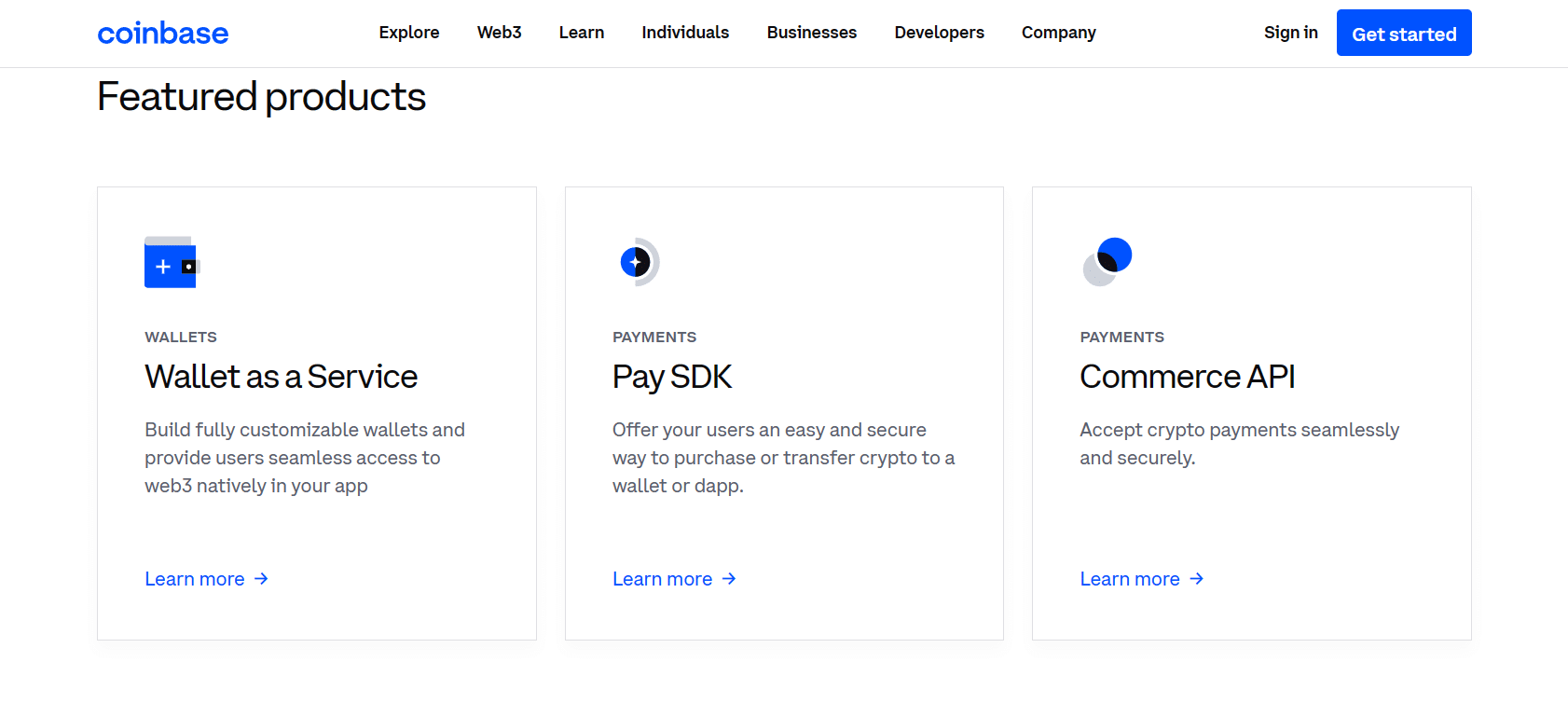

- Coinbase Wallet as a Service: Coinbase Wallet as a Service is a new product that allows developers to build native wallets directly in their dapps.

Get started with Coinbase.

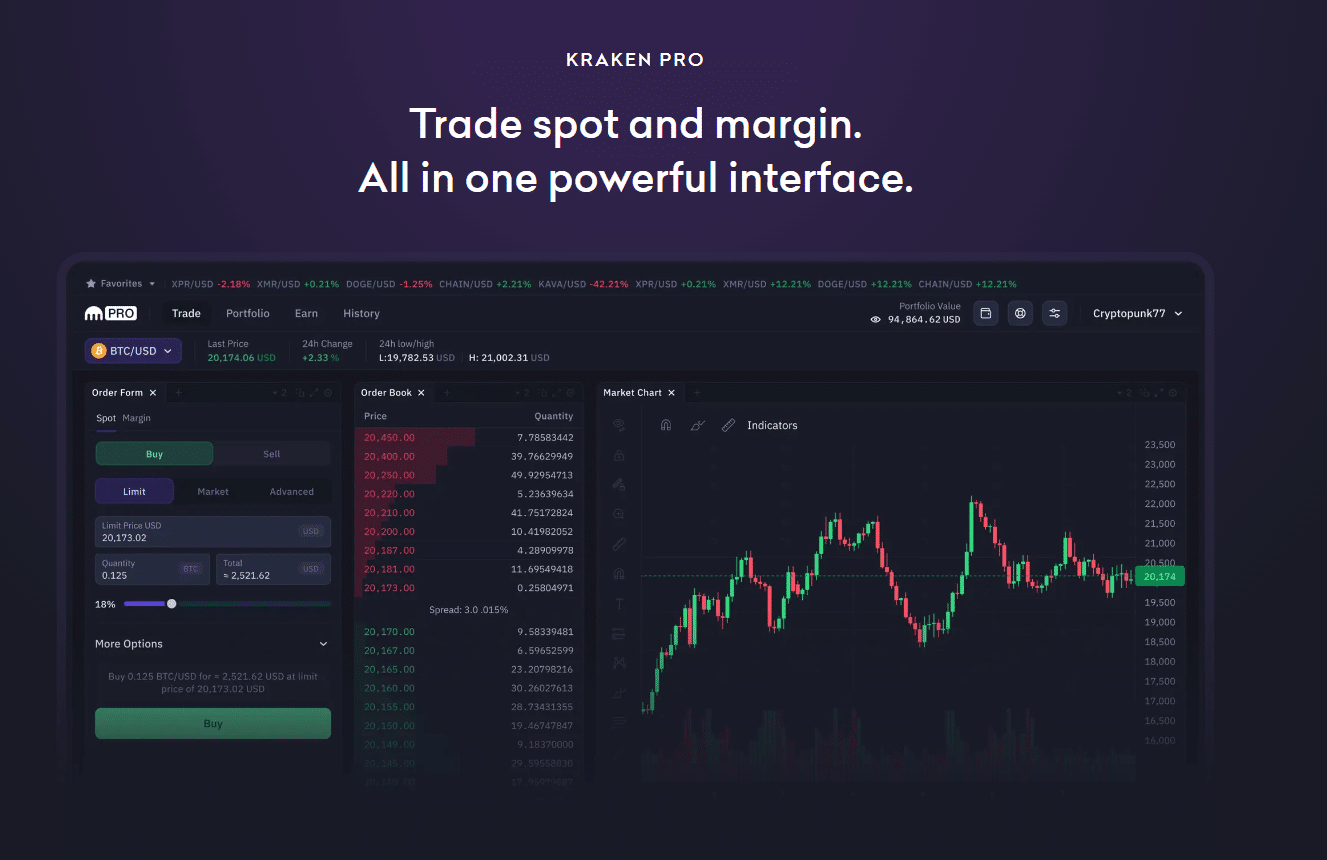

3. Kraken.

Best Recommended For Security

Our Take

Kraken is our number three selection. It is not as popular as Binance, Coinbase or even etoro but worth mentioning due to proof-of-reserve audits. Since the downfall of FTX with Sam Bankman Fried at the helm more importance is necessary for protection of funds.

| Best For | Security |

|---|---|

| Price | Visit website for fees. |

| Annual Discount | No |

| Promotion | None |

They are one of the oldest and most reputable crypto exchanges in the world, founded in 2011 and regulated in multiple jurisdictions.

Kraken offers competitive fees, ranging from 0% to 0.26% depending on the trading volume and the type of order.

User-friendly and intuitive interface, with various options for customization and personalization.

Kraken supports fiat deposits and withdrawals in multiple currencies, such as USD, EUR, GBP, CAD, JPY, and CHF

A strong community of users and developers, who can interact with each other on social media, forums, blogs, podcasts, and events.

Key Features:

- It is a crypto exchange platform that allows users to buy, sell, trade, and stake over 200 cryptocurrencies.

- It offers a wide range of services, such as NFT marketplace, margin trading, futures trading, OTC trading, staking rewards, and API trading.

- They have low spreads, deep liquidity, high rates limits, and robust security.

- They provide educational resources such as a learn center and the Crypto Guides, to help users learn more about crypto.

- It has a user-friendly and intuitive interface, with various options for customization and personalization.

- It supports fiat deposits and withdrawals in multiple currencies, such as USD, EUR, GBP, CAD, JPY, and CHF.

- It has a strong community of users and developers, who can interact with each other on social media, forums, blogs, podcasts, and events.

User Experience:

The user experience of Kraken is a topic that has been discussed by various reviewers on the web. Based on the information I found, here are some of the main points:

Mobile optimization means your site will look great on any device, and you can easily manage your content anywhere.

Overall, Kraken provides a great user experience for all levels, but it may have a steeper learning curve for beginners than some other platforms

Pricing:

Kraken has a maker-taker fee schedule with volume incentives based on your activity in the past 30 days12. The fee ranges from 0% to 0.26% of the total cost (value) of your order and depends on the following factors:The currency pair you are trading (e.g. BTC/USD, ETH/EUR, etc.)The type of order you are placing (e.g. market, limit, stop loss, etc.)The amount of liquidity you are adding or taking from the order bookThe level of your 30-day trading volume in USD equivalent

Like/Dislike About Kraken:

Like:

- Kraken offers a wide range of features and services, such as NFT marketplace, margin trading, futures trading, OTC trading, staking rewards, and API trading .

- Kraken supports over 200 cryptocurrencies, including popular ones like Bitcoin, Ethereum, Dogecoin, XRP, Cardano, and Solana .

- Kraken has low spreads, deep liquidity, high rate limits, and robust security .

- Kraken provides educational resources, such as the Learn Center and the Crypto Guides, to help users learn more about crypto.

- Kraken has a strong community of users and developers, who can interact with each other on social media, forums, blogs, podcasts, and events.

Dislike:

- Kraken requires users to sign in with their email address or username to access the platform. Some users may prefer a more anonymous or decentralized way of logging in.

- Kraken has been involved in some controversies, such as the release of the “Kraken” lawsuit by former Trump lawyer Sidney Powell, which alleged widespread election fraud in the US presidential election. Some users may question the credibility or political stance of the platform.

- Kraken has a complex verification process, which may take several days or weeks to complete depending on the level of account and the country of residence.

- Kraken has limited customer support options, such as no phone support or live chat for basic users.

- Kraken is not available in some countries or regions, such as New York State in the US or Iran in the Middle East.

Product Updates

- Kraken has launched a NFT marketplace, where users can buy, sell, and create digital collectibles on various blockchains, such as Ethereum, Solana, and Flow1.

- Kraken has added support for several new cryptocurrencies, such as Acala (ACA), Altair (AIR), Astar (ASTR), Basilisk (BSX), and Biconomy (BICO)1.

- Kraken has introduced a fee trial for clients with high trading volume, which will run until September 30, 20231. These clients can enjoy lower fees ranging from 0% to 0.08%, 0.06%, and 0.04% respectively.

- Kraken has scheduled a website and API maintenance on Monday, September 11 at 22:00 UTC, which will last for approximately 15 minutes2. During this time, the platform will be unavailable for trading and other operations.

- Kraken has improved its customer support options, such as adding live chat and phone support for all users3. Kraken also has a robust support library with in-depth articles and guides on various topics.

Get started with Kraken

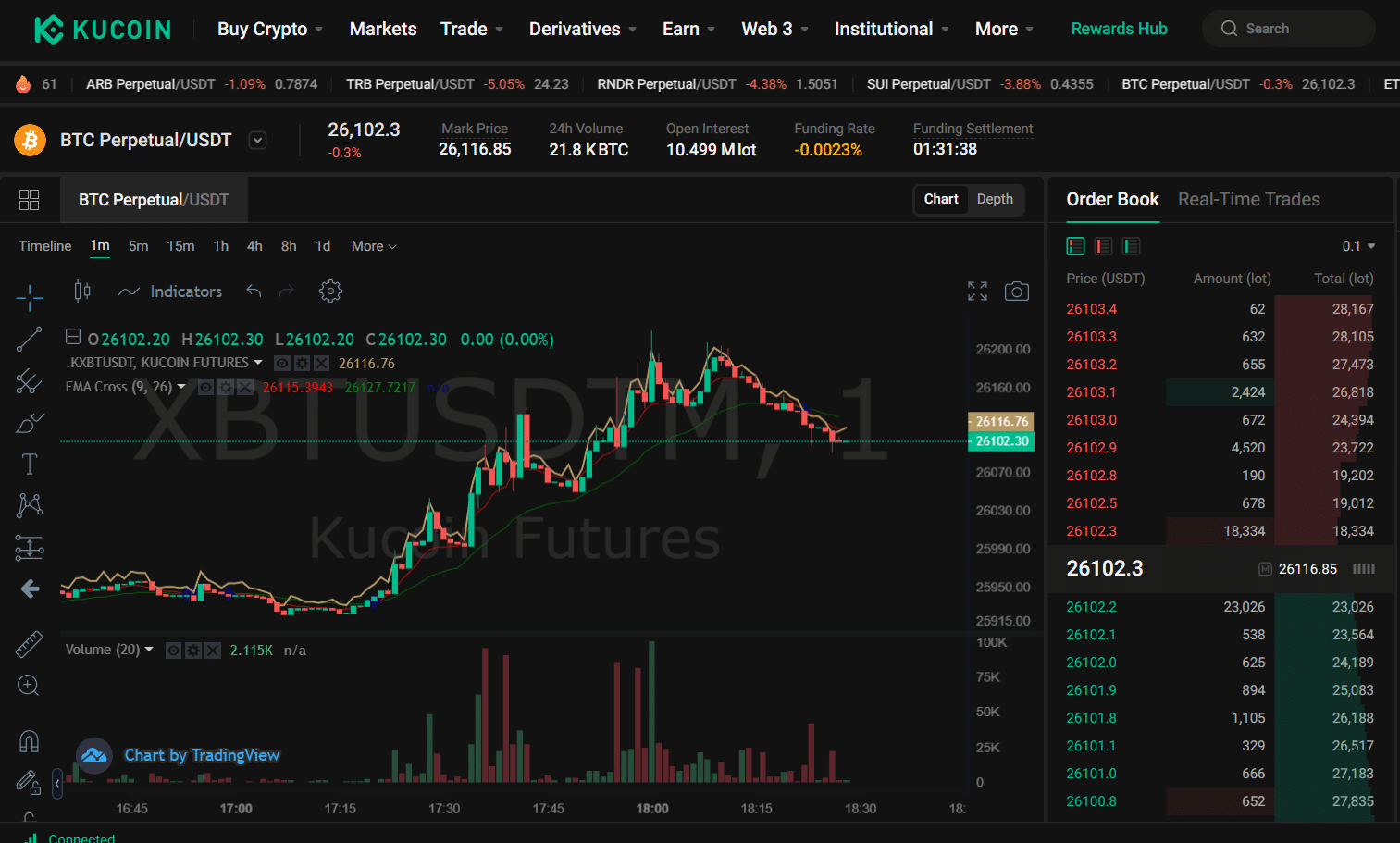

4. Kucoin.

Best For International Customers.

Our Take

KuCoin is a cryptocurrency exchange that operates in over 200 countries. While experienced traders might appreciate some of this exchange’s features, KuCoin isn’t licensed in the U.S. and has received poor reviews from users

| Best For | Best International |

|---|---|

| Price | See Website |

| Annual Discount | None |

| Promotion | Get Started Free |

KuCoin is an exchange that appeals to traders and investors of all levels of experience and risk appetite.

The platform has a simple interface that allows users to navigate through the various features of the platform on desktop, Android and iOS.

KuCoin helps users gradually learn how to use the different instruments by offering beginner settings and gamified applications like Futures Brawl.

Overall, it’s a strong platform for anyone looking to explore the variety of trading products that aren’t offered by other exchanges.

Not licensed in the U.S.: KuCoin is not licensed in the United States, so U.S.-based users should consider other exchanges.

- Poor user reviews: While negative reviews are common with crypto exchanges, KuCoin’s user reviews are especially poor. Reviewers report problems with withdrawals, customer service, and issues with market manipulation.

Launched in 2017, KuCoin is a crypto exchange headquartered in Seychelles. Since its founding, it’s grown to be one of the largest global exchanges by trade volume, and it now has over 20 million users and a presence in more than 200 countries.

Key Features:

- Low Fees, Kucoin charges 0.1% per trade and evan lower fees for futures trading.

- Kucoin offers a user friendly and cusomizable interface with advanced tools and indicators.

- Massive selection of tradeable coins, markets and instuments, access to over 400 cryptocurrencies and various trading options such as spot, margin, futures, peer to peer, lendingand staking.

- Strong reputation as they have a large user base with a high level of security and complience.

- Impressive earn section allows users to generate income and increase the value of their holdings by using Kucoin Staking, Kucoin Promotions, Kucoin Burning Drop and Polkadot Parachain Auctions.

User Experience:

KuCoin is a cryptocurrency exchange platform that has been in operation since 2017. It offers a wide range of altcoins and has a user-friendly website and mobile app .

However, some users have reported issues with the platform’s customer service, software glitches, and SMS verification codes not working . Additionally, KuCoin has been banned from operating in Ontario by the Ontario Securities Commission (OSC) for not complying with the OSC’s regulations .

It is important to note that while some users have had negative experiences with KuCoin, others have found it to be a reliable platform for trading cryptocurrencies . If you are considering using KuCoin, it is recommended that you conduct thorough research on the platform and its features before making any decisions.

Pricing:

Fees vary and are calculated on percentage basis. Cick here to acces the fees section on the website.

Like/Dislike

Like:

- Launched in 2017, KuCoin is a crypto exchange headquartered in Seychelles. Since its founding, it’s grown to be one of the largest global exchanges by trade volume, and it now has over 20 million users and a presence in more than 200 countries

- While U.S. users can sign up for a KuCoin account, access to features is limited because KuCoin isn’t licensed to operate in the United States. Given this, signing up for an account could present some risks.

- Those looking for a wide selection of assets may appreciate what this exchange provides.

Dislike:

- If U.S. regulators decide to crack down on KuCoin, you might not be able to withdraw your assets. The exchange has also had regulatory issues in countries like The Netherlands and Canada.

- When FTX fell in November 2022, a lot of users rumored that KuCoin had significant exposure to FTX. KuCoin CEO Johnny Lyu assured users that it had no exposure and wasn't connected to FTX in any way. In light of those events, KuCoin released a Proof of Reserves like other crypto exchanges to solidify user trust.

Product Updates

- Once logged in on desktop or mobile, KuCoin users can click to view markets, buy crypto, trade, lend crypto, and more. The platform supports four order types—market, limit, stop-limit, and stop-market.

- Margin, futures, and P2P trading are also available, which could be a plus for certain users. Additionally, KuCoin supports staking and recently introduced a Trading Bot feature to help simplify the trading process; it essentially acts as a robo-advisor for your cryptocurrency portfolio.

While this exchange offers many options, its desktop and mobile platforms aren’t particularly user-friendly. That said, the site does offer a robust help center where users can find answers to common questions.

Get started with Kucoin

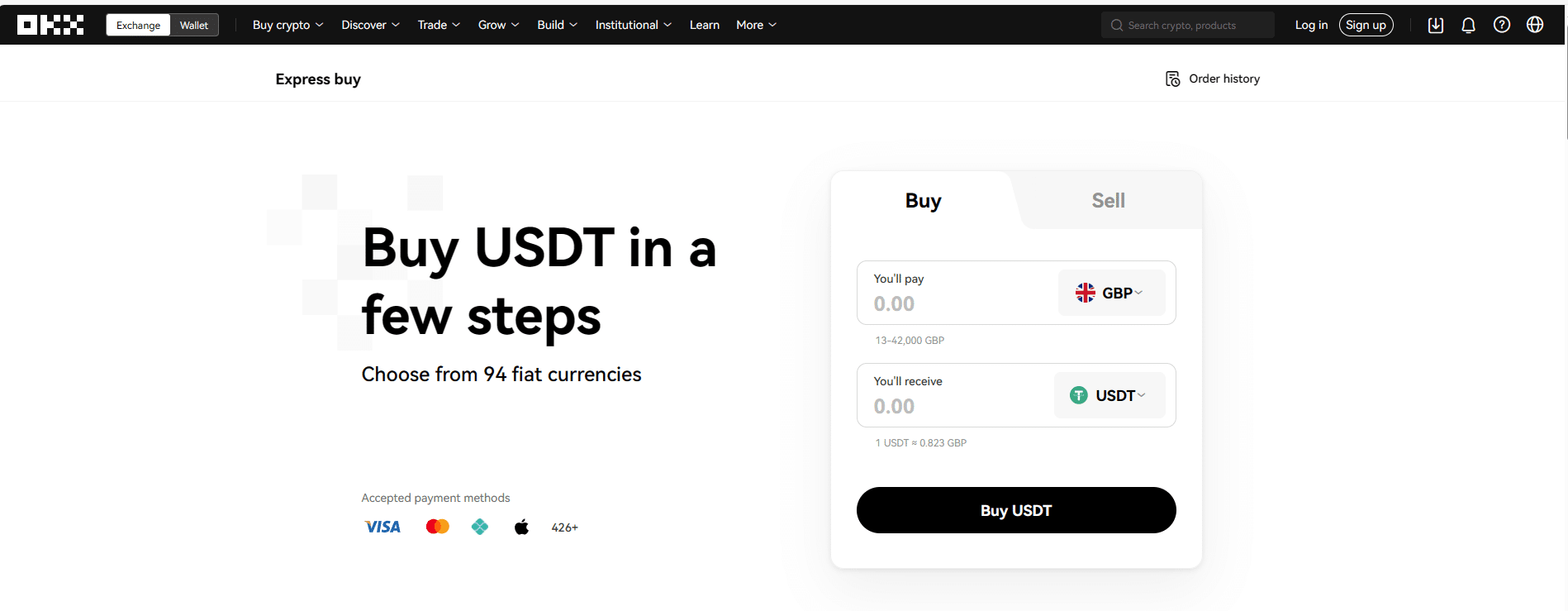

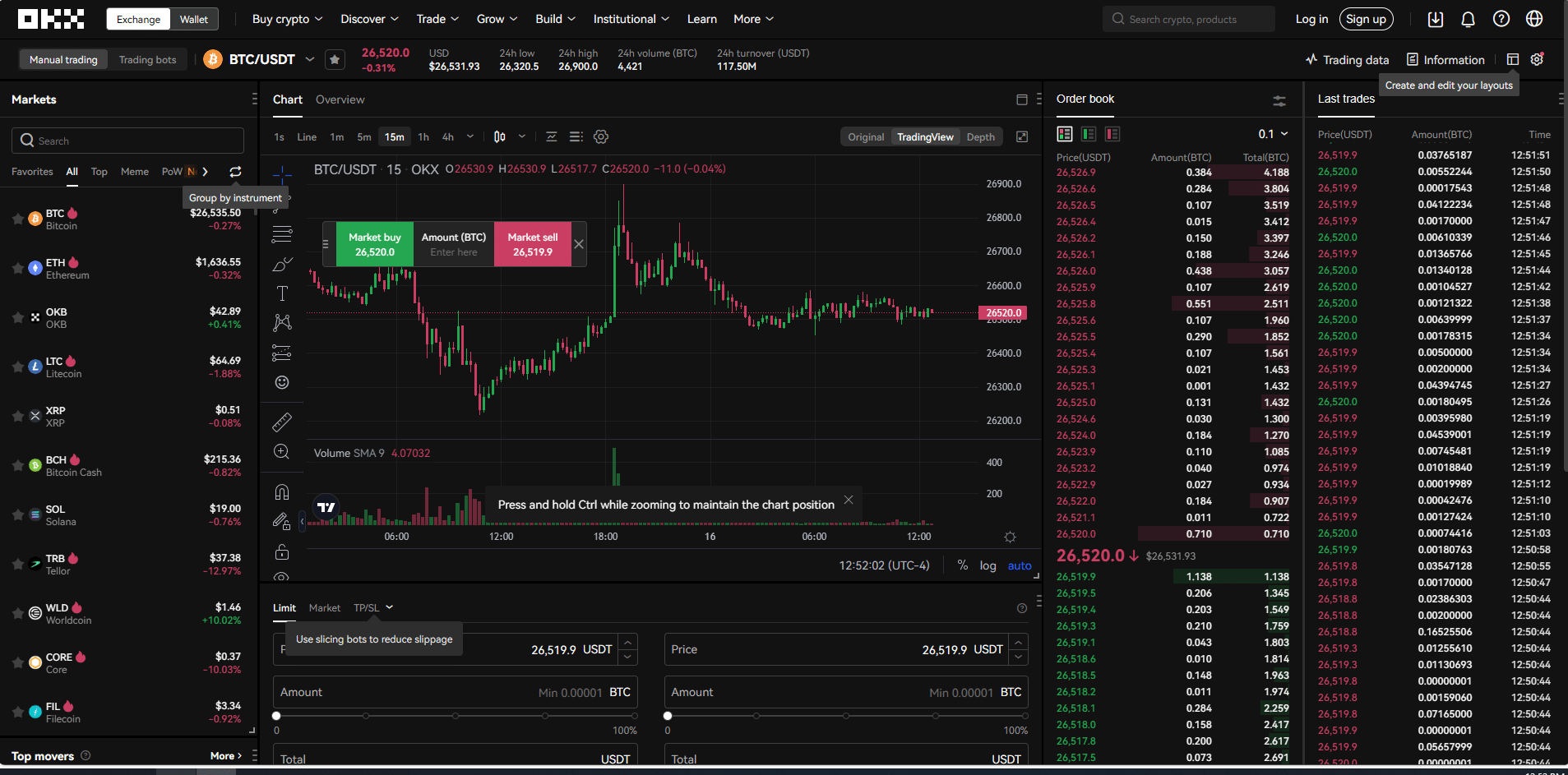

5. OKX

Best International

Our Take

OKX supports over 300 cryptocurrencies and 30 fiat currencies, and has a large user base of over 20 million in more than 200 countries. However, is OKX safe and reliable? Here are some of the pros and cons of using OKX broker.

| Best For | Ease Of Use |

|---|---|

| Price | See Website For Fees |

| Annual Discount | NONE |

| Promotion | Get Started Free |

- OKX has multiple trading platforms that cater to different levels of experience and preferences. You can use OKX Express for quick and easy crypto purchases, P2P trade for peer-to-peer transactions, Convert for instant swaps between cryptocurrencies, Basic Trading for spot trading with low fees, and Margin Trading for advanced trading with futures, options, perpetual swaps, and leverage

- They offer attractive DeFi services that allow you to earn passive income from your crypto assets. You can stake your coins and tokens in various pools and earn high annual percentage yields (APYs) up to 30%2. You can also borrow crypto-backed loans with low interest rates and flexible repayment terms1.

- OKX has a comprehensive learning center that provides tutorials, research, and market analysis to help you learn about cryptocurrency and blockchain. You can access OKX Academy, OKX Research Institute, OKX Insight, and OKX Community to get the latest information and insights on the crypto industry

- They have implemented a strong security system that protects your funds and data. It uses cold storage wallets, multi-signature verification, SSL encryption, anti-DDoS protection, and KYC verification. It also has a security response center that monitors and responds to any potential threats or incidents

Key Features:

- Trading: OKX has multiple trading platforms that cater to different levels of experience and preferences. You can use OKX Express for quick and easy crypto purchases, P2P trade for peer-to-peer transactions, Convert for instant swaps between cryptocurrencies, Basic Trading for spot trading with low fees, and Margin Trading for advanced trading with futures, options, perpetual swaps, and leverage.

- Staking: OKX offers attractive DeFi services that allow you to earn passive income from your crypto assets. You can stake your coins and tokens in various pools and earn high annual percentage yields (APYs) up to 30%2. You can also borrow crypto-backed loans with low interest rates and flexible repayment terms.

- Learning: OKX has a comprehensive learning center that provides tutorials, research, and market analysis to help you learn about cryptocurrency and blockchain. You can access OKX Academy, OKX Research Institute, OKX Insight, and OKX Community to get the latest information and insights on the crypto industry.

- Security: OKX has a strong security system that protects your funds and data. It uses cold storage wallets, multi-signature verification, SSL encryption, anti-DDoS protection, and KYC verification. It also has a security response center that monitors and responds to any potential threats or incidents

- NFT Marketplace: OKX has a cross-chain NFT marketplace that supports Ethereum, Solana, Polygon, and more. You can buy, sell, create, and collect NFTs on OKX with low fees and high liquidity.

User Experience:

User experience of OKX seems to be mixed, with some users praising its versatility, competitiveness, and intuitiveness, while others criticizing its controversies, complexity, and poor customer service.

OKX has been involved in some controversies and scandals that have damaged its reputation. In October 2020, OKX suspended withdrawals for over a month due to an investigation by the Chinese authorities on its founder. In April 2021, OKX implemented a lifetime withdrawal limit policy that angered many users who felt it was unfair and restrictive13.

OKX has a complex fee structure that can be confusing and expensive for some users. It charges different fees depending on the trading platform, trading pair, trading volume, account level, payment method, and currency. It also has hidden fees such as network fees, deposit fees, withdrawal fees, and conversion fees that can add up quickly13.

Customer service has been rated as poor that is slow and unresponsive. Many users have complained about the lack of communication and support from OKX staff. Some users have reported issues such as delayed deposits, missing withdrawals, frozen accounts, technical glitches, and lost funds that were not resolved by OKX customer service13.

Pricing:

The fees start at 0.10% for both makers and takers in spot trading, and decrease as your trading volume or OKB holding increases. For example, if you have a 30-day spot trading volume of 10,000,000 USD or a total OKB holding of 500 OKB, you will pay 0.075% as a maker and 0.095% as a taker.

The fees for futures, swaps, options, and spreads are also based on your trading volume or OKB holding, but they vary depending on the type of contract and the leverage you use. For example, if you trade USDT-margined futures contracts with 10x leverage or less, you will pay 0.020% as a maker and 0.060% as a taker if you have a 30-day total trading volume of futures and perpetual contracts of 20,000,000 USD or more1.

OKX also charges other fees such as network fees, deposit fees, withdrawal fees, and conversion fees. These fees depend on the currency and the network congestion at the time of the transaction.

Like/Dislike About OKX:

Like:

- Multiple trading platforms that cater to different levels of experience and preferences.

- Attractive DeFi services that allow you to earn passive income from your crypto assets.

- Comprehensive learning center that provides tutorials, research and market analysis.

- Strong security system that protects your funds and data.

Dislike:

- OKX has been involved in some controversies and scandals that have damaged its reputation.

- OKX has a complex fee structure that can be confusing and expensive for some users.

- OKX has a poor customer service that is slow and unresponsive.

Product Updates

- OKX has announced updates to its profit-sharing feature on its Copy Trading product. Copy Trading is a service that allows users to follow and copy the trades of experienced traders on OKX. The profit-sharing feature enables users to share a percentage of their profits with the traders they follow as a reward for their performance. The updates include lowering the minimum profit-sharing ratio from 10% to 5%, allowing users to adjust the profit-sharing ratio at any time, and adding more options for profit-sharing periods.

- OKX has launched a cross-chain NFT marketplace that supports Ethereum, Solana, Polygon, and more. Users can buy, sell, create, and collect NFTs on OKX with low fees and high liquidity. The NFT marketplace also integrates with OKX’s DeFi services, such as staking and lending, to offer more benefits for NFT holders2

Get started with OKX.