Best Brokers For Forex Trading (2024)

Forex trading is the process of exchanging one currency for another in the global market. Forex traders speculate on the fluctuations of exchange rates and profit from the differences between buying and selling prices. It is one of the most popular and liquid financial markets in the world, with an average daily turnover of $10 trillion.

Forex trading is done over the counter (OTC), which means that there is no central exchange or clearing house that regulates the transactions. Instead, forex trading is conducted electronically through a network of banks, brokers, dealers, and other markets participants.

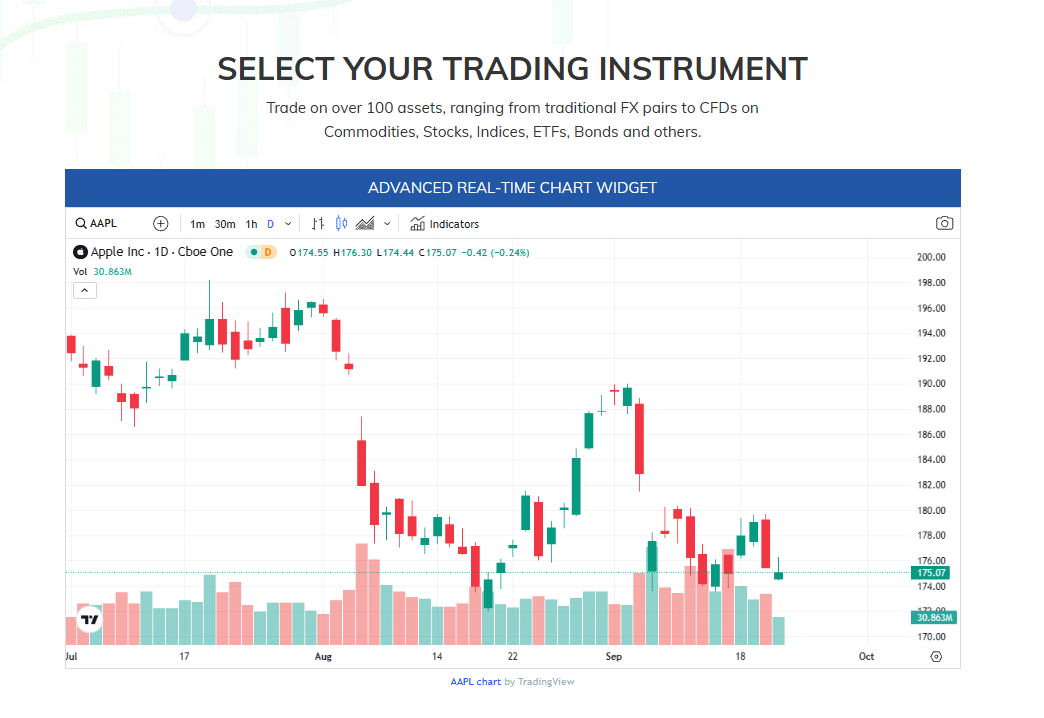

Avatrade

Avatrade is a well regulated broker that has been in the online trading industry since 2006.The company offers a wide choice of assets, leading platforms and generous trading conditions.

Forex.com

A wholly own subsidiary of Stone X Group, a Fortune 100 financial giant with revenues of over 54 billion. Established in 2001 they offfer comprehensive education.

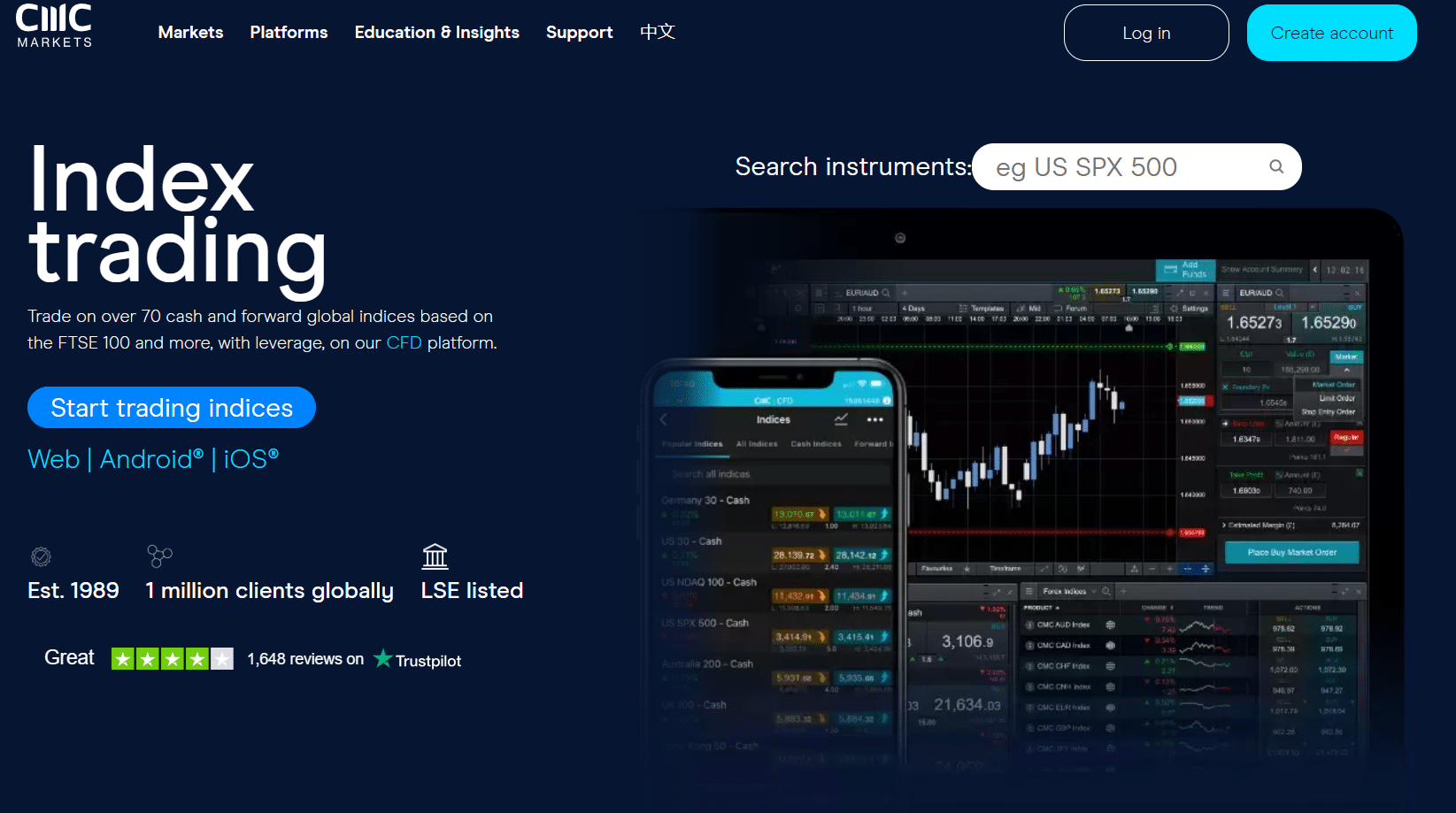

CMC MARKETS

A UK based financial services company that offers online trading in shares, spread betting contracts for different (CFDs) and foreign exchange across world markets.

fpmarkets

FP Markets is best for small investors who want to access a broad range of markets, both domestically and globally, that have previously been difficult for them to access .

Who Are The best Forex Brokers?

The Forex market is open 24 hours a day, five days a week.

Please note that forex trading involves risks and it’s important to educate yourself about the markets before getting started.

1. Avatrade

Best Broker Overall.

Our Take

| Best For | Competive Spreads |

|---|---|

| Price | Visit Website |

| Annual Discount | No |

| Promotion | None |

AvaTrade is a privately held online forex and CFD (contract for difference) broker. It was founded in 2006 as AvaFX and it advertises that it's "committed to empowering people to invest and trade, with confidence, in an innovative and reliable environment; supported by best-in-class personal service and uncompromising integrity."

Headquartered in Dublin, Ireland, AvaTrade has satellite offices throughout Europe and the Asia-Pacific region. It's registered with multiple jurisdictions globally. But like many forex brokers, AvaTrade does not accept U.S. traders.

AvaTrade offers a broad variety of tradable instruments with industry standard spreads on a "wide selection of trading platforms for both manual and automated trading, across a variety of device types." Instruments include forex, stocks, commodities, cryptocurrencies, and indices.

Traders can open accounts for as little as 100 units of the base currency and the broker offers dedicated educational resources that should get them up to speed quickly. AvaTrade states that accounts across all jurisdictions do have negative balance protection and it also offers AvaProtect, which allows clients to take out insurance on a trade.

AvaTrade isn't regulated by the Financial Conduct Authority (FCA), a highly regarded regulatory entity with a reputation for being strict in ensuring that market practices are fair for both individuals and businesses. It's not subject to ESMA-mandated client account protection and leverage restrictions.

You can quickly contact the friendly customer care team through live chat, phone, or email.

With their assistance, you’ll be able to quickly solve any technical issues and create a successful online trading experience.

AvaTrade offers negative balance protection and AvaProtect, which allows clients to take out insurance on a trade.

Key Features:

- AvaTrade is for novice investors who seek to gain a basic understanding of forex and CFD trading.

- AvaTrade offers negative balance protection and AvaProtect, allowing clients to take out insurance on a trade.

- This broker is not regulated by the FCA.

- AvaTrade offers customers copy and social trading with AvaSocial, ZuluTrade, DupliTrade, and MQL5 Signal service.

- Not available to U.S. clients as they are not regulated to do so.

User Experience:

Easy-to-use. Avatrade platform provides a range of markets to choose from.

Pricing:

Avatrade charges inactivity fee after three months. Other administrations fees also apply.

Like/Dislike About Avatrade

Like

- Full range of Forex, CFD, and crypto offerings

- Unique trading features

- Impressive and wide range of education.

- Negative balance protection

- Support: 24/7 live customer support.

Dislike:

- Not regulated by the FCA

- Trading platform lack the news and research

- No guaranteed stop loss

Product Updates

- Experienced traders can qualify for a "professional" account which would allow them to increase their maximum leverage from 30:1 to 400:1, but the spreads remain the same.

Get started with Avatrade

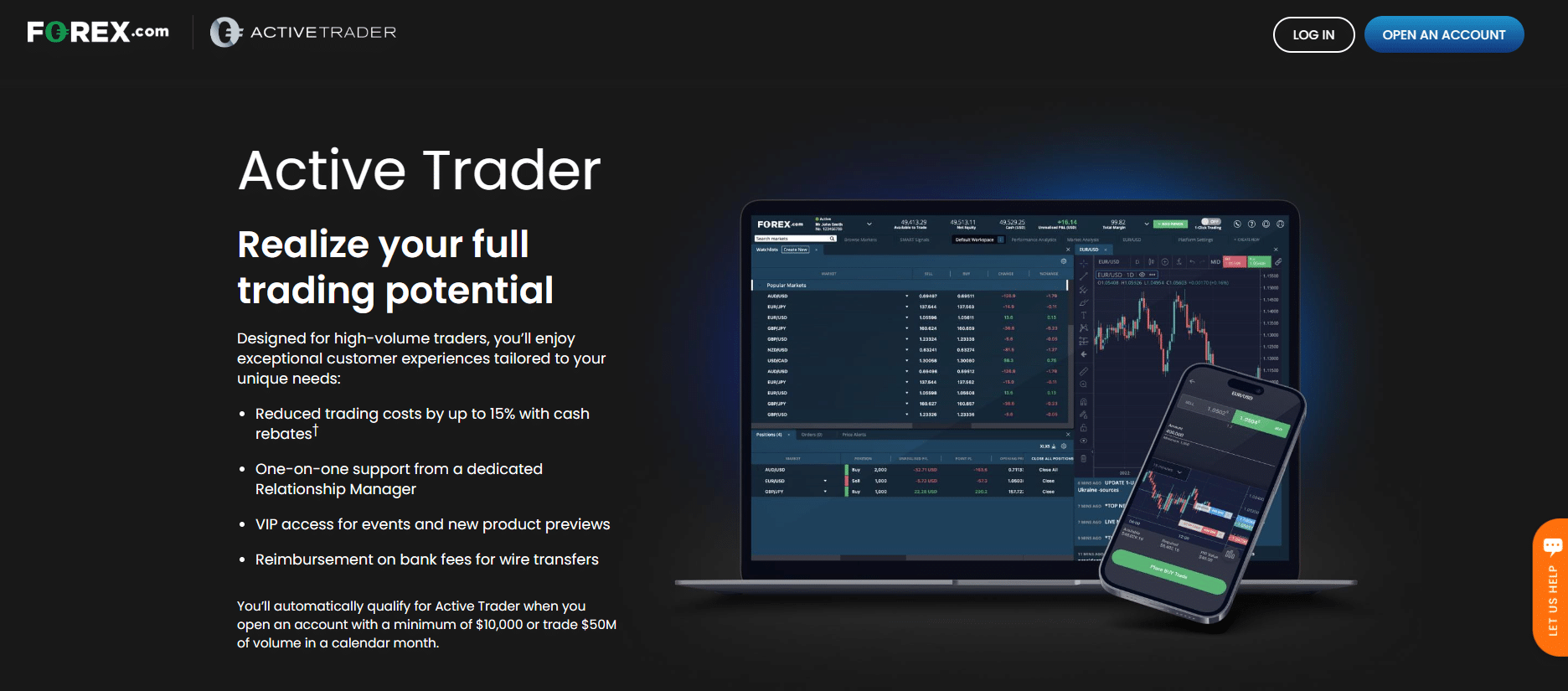

2. Forex.Com

Best For International and Intermediate Investors

Our Take

| Best For | Day Traders And Investors |

|---|---|

| Price | Done On Spread |

| Annual Discount | No |

| Promotion | None |

Forex.com claims to be the #1 FX broker in the U.S., with over 80 currency pairs and competitive spreads

. It also offers a range of other products, such as commodities, indices, stocks, bonds, ETFs, gold & silver, cryptocurrencies, and futures.

Regulated in the following countries: USA, UK, Canada, Japan, Cayman Islands, Cyprus, Hong Kong, Singapore, Australia.

Forex.com has low fees for forex trades and there is no withdrawal fee. On the other hand, stock CFD fees are high and there is an inactivity fee.

Forex.com's account opening is seamless and fully digital, with a low minimum deposit. On the other hand, account verification takes around 2 business days, which is not the fastest on the market.

Forex.com's web trading platform is user-friendly and extremely customizable, with lots of order types. On the negative side, there is no two-step login..

Key Features:

- It is a well-established and regulated online broker that offers forex and CFD trading to clients around the world .It has over 80 currency pairs and competitive spreads, as well as a range of other products, such as commodities, indices, stocks, bonds, ETFs, gold & silver, cryptocurrencies, and futures .

- It provides multiple trading platforms, including its own proprietary web platform, MetaTrader 4, MetaTrader 5, and NinjaTrader. The platforms are user-friendly and customizable, with advanced charting and analysis tools .It offers a variety of educational and research resources, such as webinars, articles, videos, podcasts, trading signals, market news, and an economic calendar .

- It has a low minimum deposit requirement of 100 units of base currency for most account types. It also offers several account options, such as standard, commission, direct market access (DMA), and professional accounts .It has a high customer satisfaction rating on Trustpilot, with 60% of reviewers giving it 5 stars. Many customers praise its customer service, execution speed, and platform reliability

User Experience:

- The trading platforms of Forex.com are comprehensive and advanced, with a wide range of trading tools and indicators, as well as customizable features and settings. The platforms include its own proprietary web platform, MetaTrader 4, MetaTrader 5, and NinjaTrader.

- Customer service is responsive and helpful, with various channels of communication, such as phone, email, live chat, and social media. The customer service representatives are knowledgeable and courteous, and can assist with various issues and inquiries

Pricing:

The customer satisfaction of Forex.com is high, with 60% of reviewers on Trustpilot giving it 5 stars. Many customers praise its execution speed, platform reliability, and educational resources2.

Like/Dislike About Forex.com

Like:

- Clear free reports and charts.

- Fast and stable user interface.

- News integration and alerts can give added support to your trading.

Dislike:

- No two step (safer) login.

Product Updates

- Forex.com has two web trading platforms, Web Trader and MetaTrader 4. In addition, MetaTrader 5 is also available in several jurisdictions, such as Canada, countries in the European Economic Area (EEA) and clients regulated by the Cayman Islands Monetary Authority (CIMA).

Get started with Forex.com

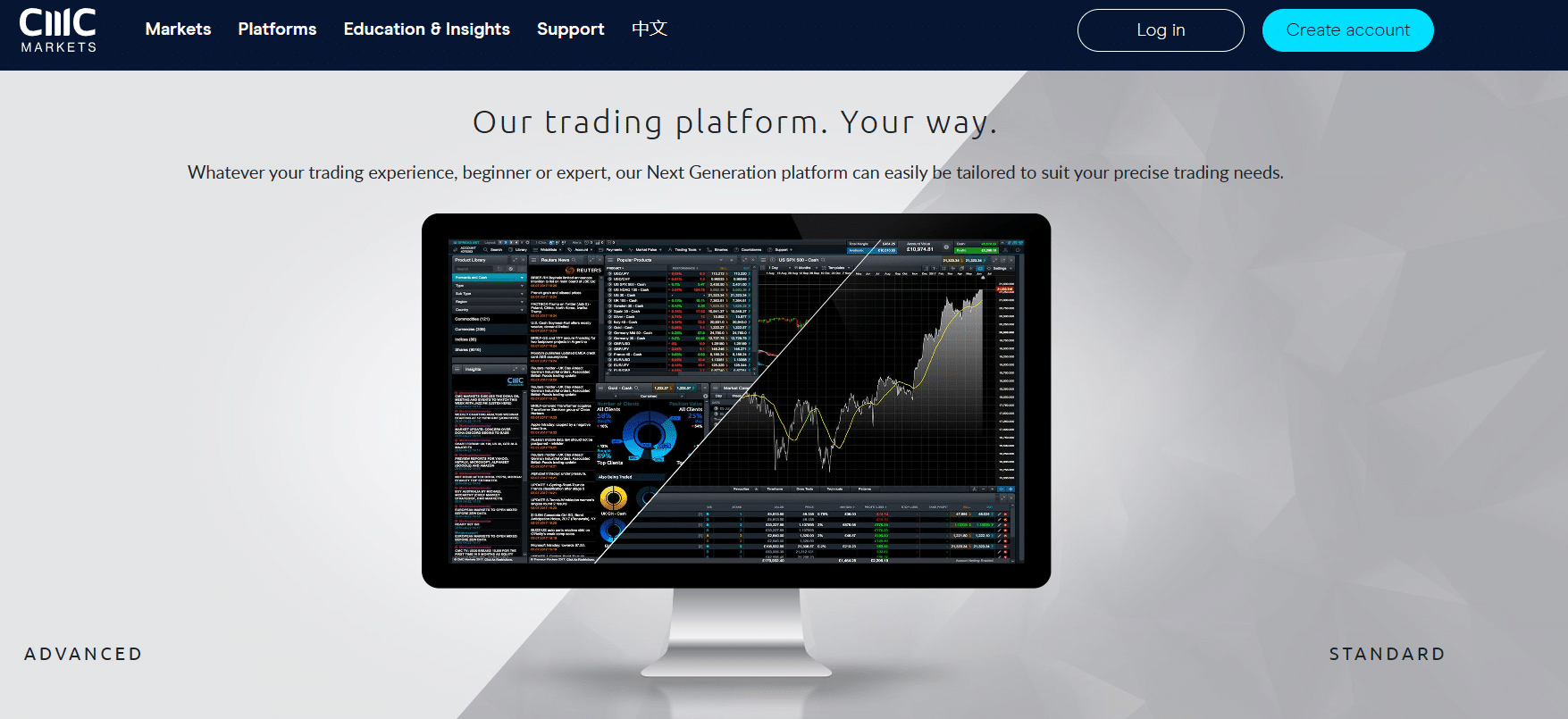

3. CMC MARKETS

Best For International Multi Asset Trading

Our Take

| Best For | Range Of Tradable Assets |

|---|---|

| Price | Varies by Region |

| Annual Discount | No |

| Promotion | None |

CMC Markets is a UK-based global CFD and forex broker that is regulated by multiple top-tier authorities including the UK FCA.

They have low forex fees, and there is no charge for most deposit and withdrawals options.

The web and mobile trading platforms are well-designed, highly customizable and rich with features such as an advanced order panel.

.

Research and educational tools are also wide-ranging and sophisticated.

.

On the downside, stock CFD fees are high. The product portfolio covers only CFDs (forex, indices, commodities, shares, ETFs, bonds, crypto - except for UK clients).

Key Features:

- Invest in stocks with zero % commission.

- From technology to healthcare, New York to Hong Kong — with fractional shares, it’s easy to fill your portfolio with a variety of leading stocks from the world’s top exchanges.

- Invest in stocks without paying commission and without limits on trading volume.

- Trade a wide variety of leading cryptoassets and crypto crosses, using innovative tools that you won’t find anywhere else. eToro Crypto offers the ultimate crypto solution: trading platform, wallet, and exchange all in one, with the security of a regulated fintech leader.

- Take advantage of exciting opportunities in the world’s top resource markets. With one-click trading, flexible leverage, and deep liquidity, trading commodity CFDs allows you to choose an investment amount without being limited to units, such as a whole barrel of oil or an ounce of gold.

- Trade on the largest, most active financial market in the world — the foreign currency exchange, also known as FX. Buy and sell a wide variety of major USD pairs and other currency crosses, with up to 1:30 leverage (or up to 1:400 as a Professional Client) to gain greater exposure with less capital.

- Trade on the largest, most active financial market in the world — the foreign currency exchange, also known as FX.

- Expand your exposure with indices that you can trade.

- Exchange-traded funds (ETFs) allow investors a flexible yet comprehensive way of investing in the financial markets at a low-cost entry point and without management fees — making them ideal for portfolio diversification. eToro offers both investing in ETFs as the underlying asset, as well as trading them as CFDs.

User Experience:

- CMC Markets offers an excellent, intuitive experience for its users. The broker’s advanced research support tools can prove to be invaluable for its clients.

Pricing:

According to CMC Markets’ official website, the prices of their products are generated electronically by the platform and are based on the market prices of the relevant underlying products. The prices of their products are sourced from industry-leading data vendors for products that are predominantly traded on an exchange, and directly from their liquidity providers for products that are predominantly traded over the counter (OTC), such as forex .

Like/Dislike

Like:

- Low forex fees.

- Great web and mobile plarforms.

- Advanced research and educational tools.

Dislike:

- High stock CFD fees.

- Only CFDs are available.

- Customer support only 24/5.

Product Updates

- It’s important to note that while CMC Markets has a clean track record and is trusted by many. It may not be the best fit for everyone.

Get started with CMC MARKETS

4. fpmarkets

Best For Stocks And Options

Our Take

FP Markets offer trading in over 60 currency pairs on MT4, more than 10,000 stocks on global exchanges, 19 major global indices, commodities such as coffee, natural gas, corn and more, US10YR & UK Long Gilt Futures GILT, and metals such as gold, oil, silver and more .

| Best For | Best For Small Investor |

|---|---|

| Price | See Website For Details |

| Annual Discount | NONE |

| Promotion | Get Started With Demo Account |

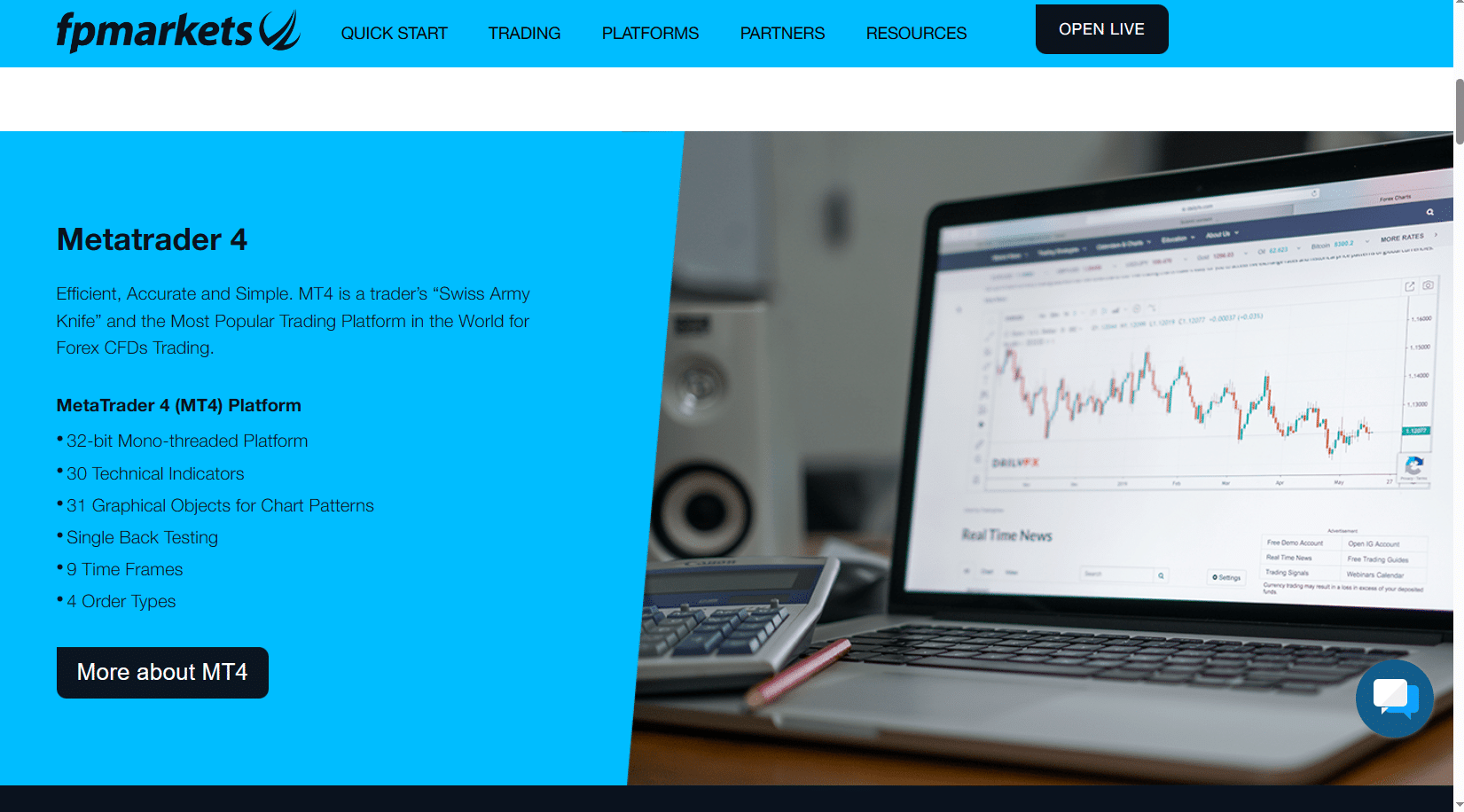

FX Empire notes that FP Markets lacks a proprietary platform but supports the widely popular MetaTrader 4&5 and cTrader.

Another advantage is the offering of Virtual Private Server (VPS) hosting, which enhances the platform’s overall performance. However, the one drawback of FP Markets’ service is the lack of good research content in terms of quantity and quality.

Forex Peace Army recommends FP Markets for high leverage trading on forex. They tested trading on MT4 and withdraws with no issues. They also provide live chat customer service which answers very fast.

Overall, FP Markets is a well-regulated broker with good trading environment suitable for beginners and experienced traders too.

They offer low forex fees and have several excellent educational tools such as demo accounts and e-books

Key Features:

- FP Markets is a one-stop destination to trade CFDs across Forex, Shares, Indices, Commodities, Cryptocurrencies, Bonds & ETFs

- The range of trading accounts offers you consistently tighter spreads, starting from as low as 0.0 pips. They have partnered with leading banking and non-banking financial institutions to provide a deep liquidity pool, offering among the best available market prices.

- Access over 10,000 tradable CFD products on the world’s biggest exchanges. Choose from their powerful trading platform options including MT4, MT5 and Iress. Enjoy the added benefit of taking your trading with you via their mobile app and web based accessibility options.

- FP Markets consistently offer some of the tightest spreads in the industry. Trade from 0.0 pips on the major currency pairs.

- Ideal conditions for scalping and EAs with no minimal distance between the spread.

User Experience:

Opening an account is fairly easy. You’ll need to complete an application online. Basic information needed includes social security number or tax identification number, valid photo identification (driver’s license, passport or government-issued ID card), bank account details.

It is quick and easy to deposit funds into your FP Markets trading account. Funds can be deposited using a wide range of payment methods including credit card, debit card, payment wallets including Neteller and Skrill, online banking and bank wire transfer:

FP Markets does not charge any deposit fees and will cover internal bank fees for all international deposits.

If FP Markets receives a receipt showing the original deposit fee amount is no more than 50 USD, FPM will cover clients international bank fees (charged by the clients bank) for deposits over 10,000 USD.

They do not charge withdrawal fees however clients may be charged by an intermediary bank for international transactions.

Pricing:

FP Markets offers low forex fees The platform fee charged depends on the trading platform you choose to use. For instance, MetaTrader 4 and MetaTrader 5 are free to use, as is the Iress Mobile version which is available on Android and Apple iOS devices such as iPhone and iPad. However, for Iress Trader / ViewPoint, there is a $60 monthly fee, including. This fee is waived when a certain amount of trades are executed or commissions generated.

Like/Dislike

Like:

- Low minimum deposit of $100.

- Fast Account Opening.

- Low spreads on various currency pairs.

- 24/7 customer support.

Dislike:

- Limited range of instruments.

Product Updates

- FP Markets earns our admiration for its web and mobile trading platforms, making them a recommendation for traders of all levels. The standard platform is so user-friendly that even beginners can set up a trading account without needing extensive guidance. What’s even more appealing is the intuitive design of these platforms, ensuring smooth navigation for traders. We also liked the fact that FP Markets features social and copy trading platforms, which we highly advise you to take advantage of and enhance your trading experience.

FP Markets, a well-established name in the world of online trading, offers a comprehensive suite of financial services.

Get started with FP Markets

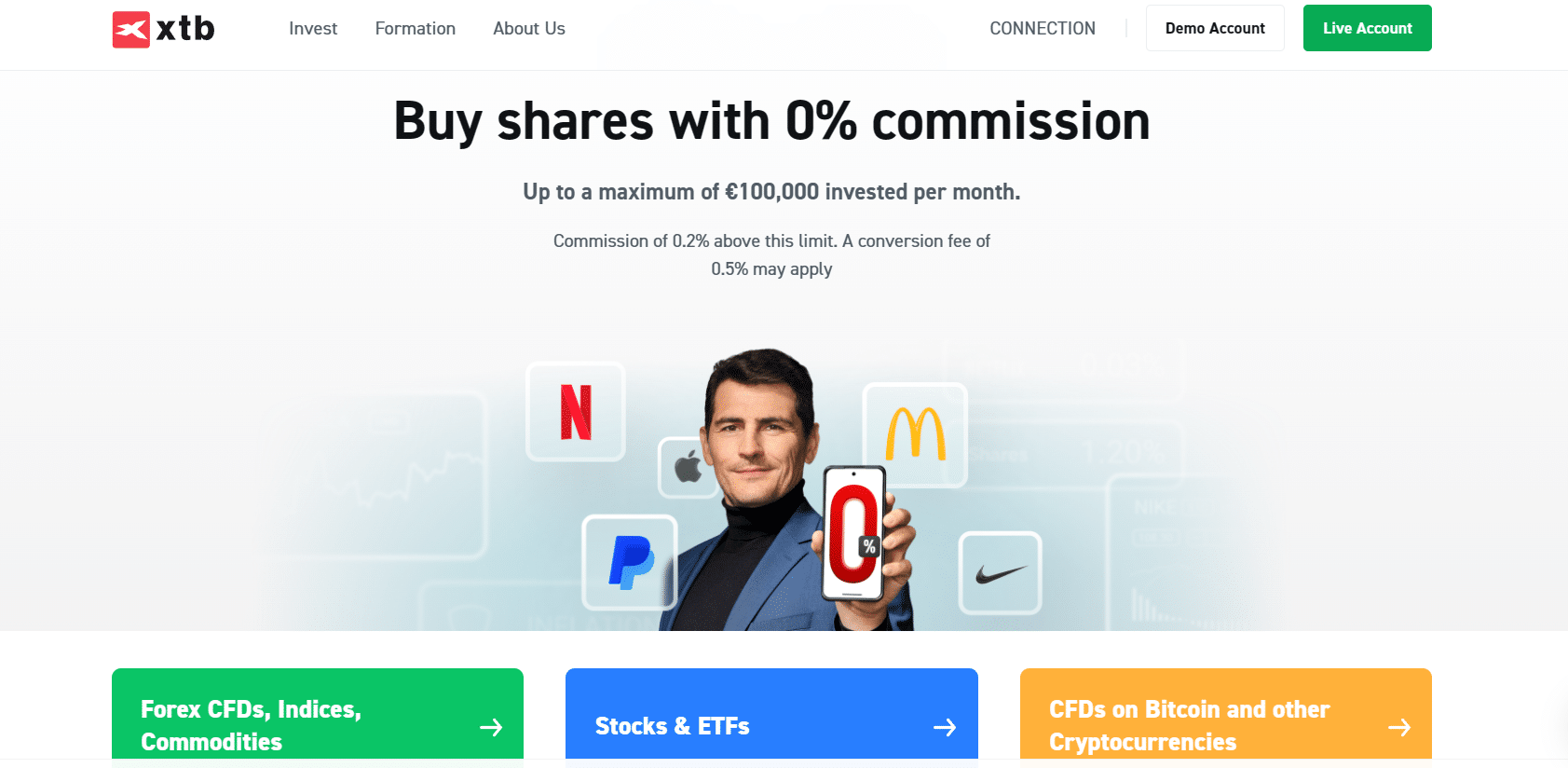

5. xtb

Best For European

Our Take

XTB is a CFD broker that provides trading services for Forex, shares, commodities, indices, cryptos, and ETFs. The company has over 781,000 clients and offers 24/5 support . XTB allows its clients to invest in real stocks with 0% commission for monthly turnover up to 100,000 EUR .The company is regulated by FCA and FSCS and is also listed on the Warsaw Stock Exchange.

| Best For | European Exchange Futures |

|---|---|

| Price | 0% Commision |

| Annual Discount | None |

| Promotion | Demo account available |

Regulated by the top-tier FCA in the UK. It was founded in 2002

They offers a smooth experience including easy account opening, convenient and mostly free deposit/withdrawal options, and user-friendly trading platforms.

XTB is highly recommend to traders that are looking for a solid and well established CFD Broker. Great choice for beginners with no minimum deposit when opening an account.

Key Features:

- XTB has low trading fees and average non-trading fees.

- In many cases, there’s no withdrawal fee, and some clients are eligible for free stock and ETF trading.

- However, there’s an inactivity fee that kicks in after one year.

- They offer a smooth experienc in opening an account with deposits and withdrawal being convinient and hassle free.

- Two types of accounts are offered, the Standard and the Pro. For both accounts you get the same trading conditions as platforms, traded instruments, support and minimal lot.

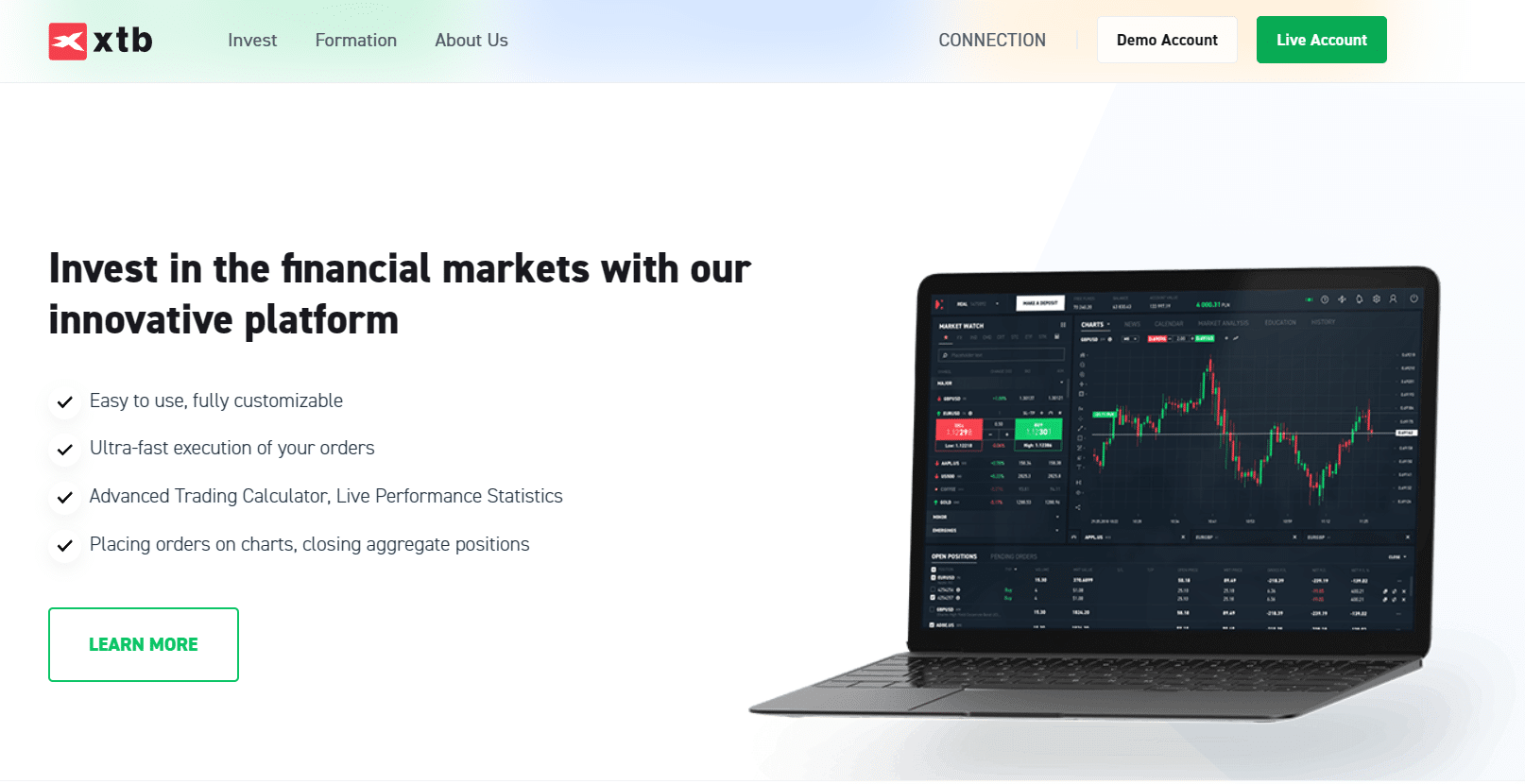

User Experience:

Easy to use, fully customizable

Ultra-fast execution of your orders

Advanced Trading Calculator, Live Performance Statistics

Placing orders on charts, closing aggregate positions

Pricing:

Grand Prix de l'Excelence 2019

xStation 5 voted Best Execution by the IAT

Commission for Stocks and ETFs: 0.2%, minimum EUR 10 for any transaction exceeding EUR 100,000 of cumulative investment on all accounts registered in a calendar month.

With nearly 20 years of experience, XTB is one of the largest publicly traded FX & CFD brokers in the world.

They have offices in more than 13 countries, including the UK, Poland, Germany, France and Chile.

Like/Dislike

Like:

- Commission-free stocks and ETFs (for trades up to €100k per month)

- Free and fast deposit and withdrawal

- Easy and fast account opening

Dislike:

- Product portfolio limited mostly to CFDs

- Inactivity fee charge

Product Updates

- Technology is one of the most important elements in the investment and financial sectors today.

- They are constantly improving our trading app in line with the latest trends and solutions. xStation one of the most reliable and functional trading apps on the market.

Get started with XTB